The Results Based Financing for Productive Appliances & Equipment aims to increase the productive use of energy in remote communities by increasing access to efficient, electric productive equipment. The component targets to electrify 24,500 MSMEs and 1,050,000 with improved access to energy services from productive use systems

The objectives of this component are to:

I. INCREASE productive use of energy in rural communities by facilitating access to energy efficient, electric productive equipment

II. ENCOURAGE developers to make productive use of power and energy-efficient appliances part of their overall strategy for mini-grid viability; and

III. ACTIVATEE the energy efficient productive use appliance and equipment market

Funding: US$19,000,000 (Total Value of results-based financing channeled to private sector providers of Productive Use Appliances and Equipment)

Energy-efficient productive use appliances

MSME’s to be headed by women

people with improved access to energy services

of beneficiaries to be headed by women

Application for Productive Use Equipment

The focus of the PUE Component is mini grid demand stimulation and is therefore geared towards facilitating the deployment of PUEs in mini grid communities.

The Programme commenced with a proof of concept phase with qualified developers of existing mini grids and is now in full implementation and open to applications from Appliance Suppliers, Appliance financiers, Co-operatives and Developers.

You can register here

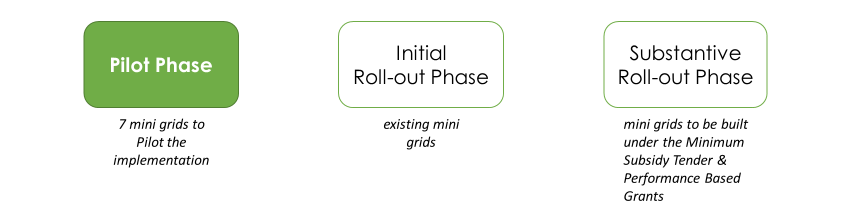

1. Proof of Concept Phase: Piloting 7 sites with various subsidy levels to assess the following:

i. Increased disposable income of MSME’s

ii. Increased demand for energy

iii. Increased mini-grid profitability/viability

iv. Socio-economic development

2. RBF initial rollout – for developers with existing mini grids (private funding, REF, PBG)

3. RBF final roll out – NEP MST Mini Grids, other mini grids

Understanding the Business models

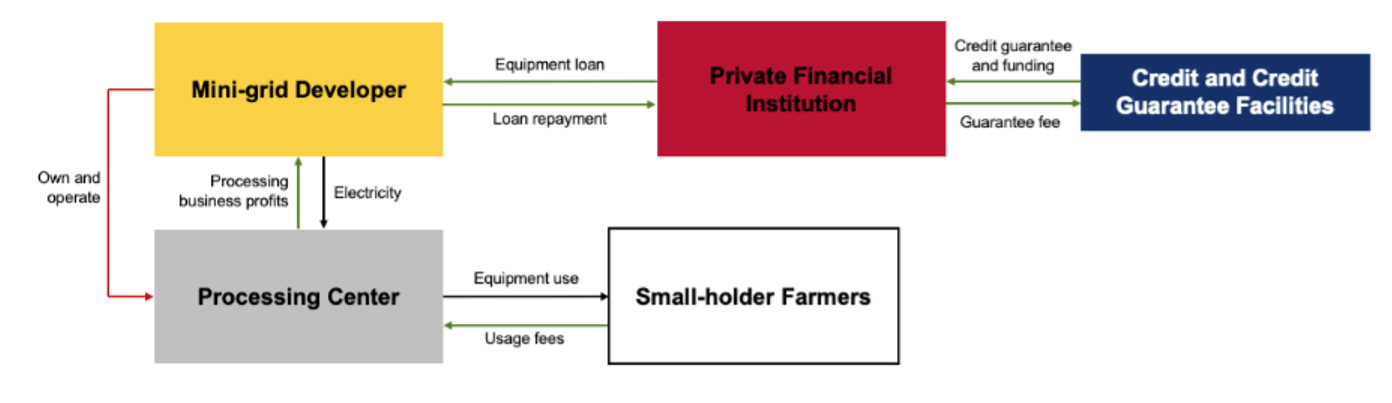

1. Processing Center Model

The Processing Center Model relies on the mini-grid developer based in a rural community to invest in, own, and operate the productive use equipment for a new processing service that existing entrepreneurs within the community are not able to solely establish.

Below, are examples of actors in the Processing Center Model:

The mini-grid developer, who already provides reliable electricity services, will be the owner of the processing center by investing in the energy-efficient productive use appliances necessary to operate the processing center/business, and will be responsible for equipment operations and equipment loan repayment. Thus, the mini grid developer will bear the credit and operational risk of this project.

A private finance institution on-lends funding from the credit facility to the mini-grid developer. The PFI should have experience lending to the agriculture/power sector because it will have a better understanding of common risks, already have mechanisms to address these risks, and be more willing to lend for agricultural activities. Alternatively, banks that are already lending to mini-grid companies may be more comfortable extending credit for a new credit line. The following banks are lending or have demonstrated interest in lending to mini-grid developers in Nigeria: Sterling Bank, First City Monument Bank, Access Bank, WEMA Bank Debt.

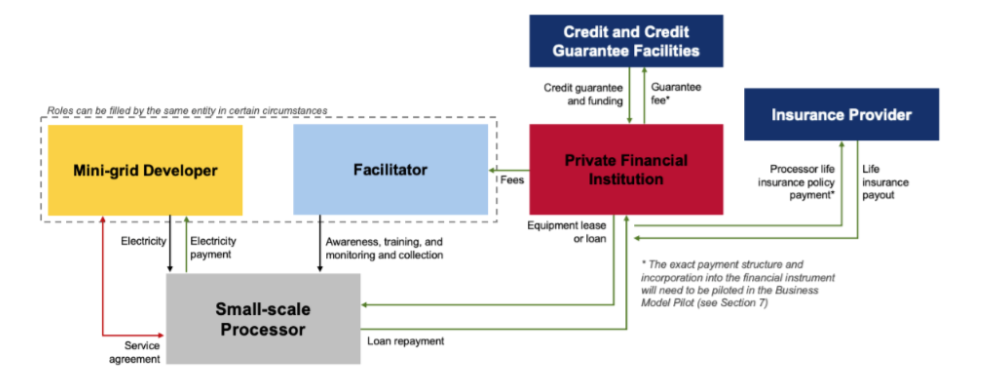

2. Facilitator Model

The Facilitator Model is led by a facilitator who enables small-scale processors to invest in equipment by serving as their education resource and connection point to finance providers. In this model, the small-scale processor will be responsible for the credit and operational risk. The facilitator builds awareness about the investment opportunity and provides business development training to support loan applications and equipment selection, within the community.

The Over time, once the viability of lending to small-scale processors is proven, the role of the facilitator would be phased out or reduced and the private financial institution (PFI) assumes the role of identifying and selecting would-be processors.

One major advantage of operating the Facilitator Model is that it de-risks participation by third parties to provide financing and capacity building, which enables equipment purchases and reduces the burden on the mini-grid developer.

List of potential Productive Use Equipment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

REA holds PUE Roundtable with Energy Access Firms

REA/NEP-AfDB SIGNS CONTRACT WITH FIVE DEVELOPERS ...